Sales Procedure Guide

2.2 // Services

Evolution supports partners in many aspects of their business, including technology, processes, systems, and support. This section details each, explaining how they work, what they deliver to consumers, and some feedback from existing partners.

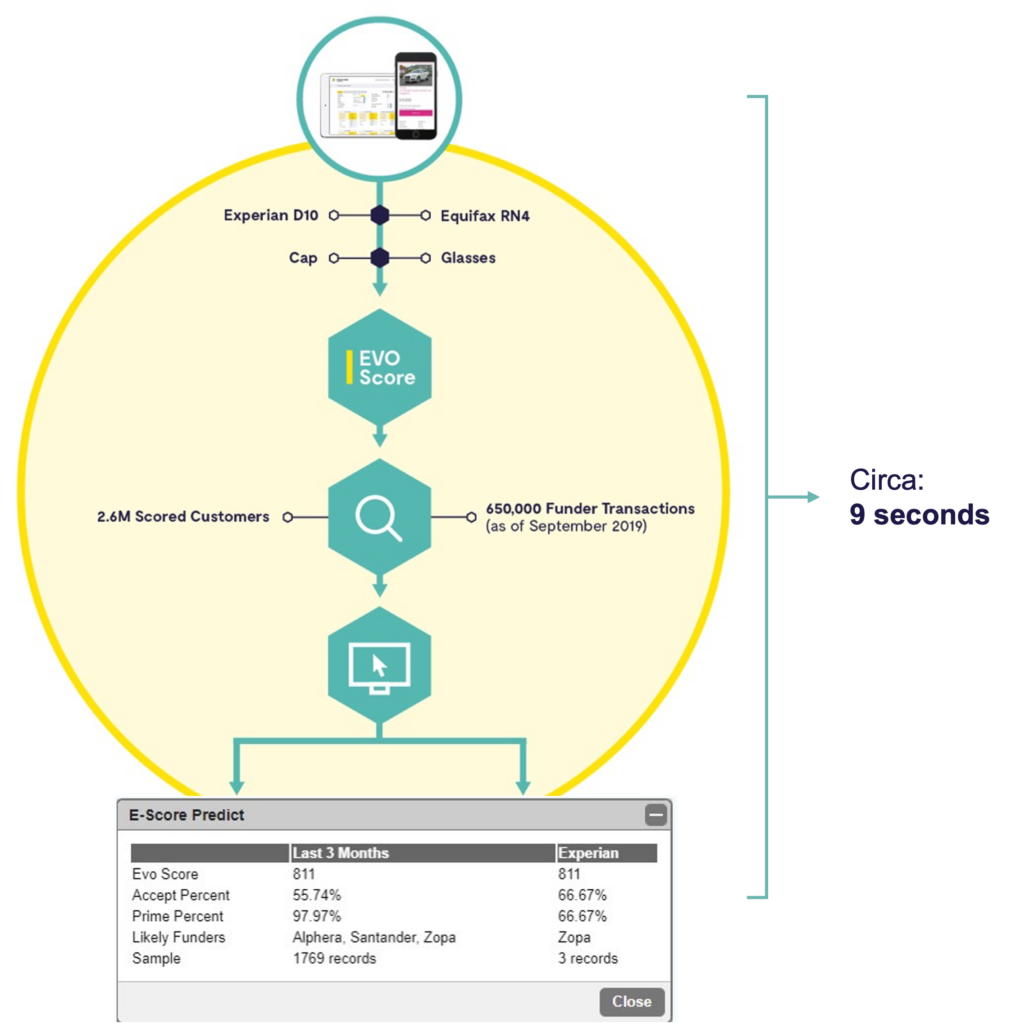

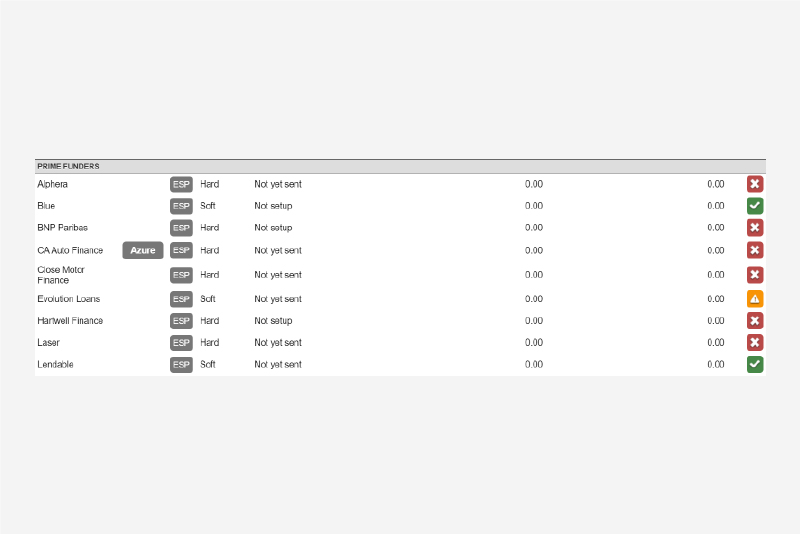

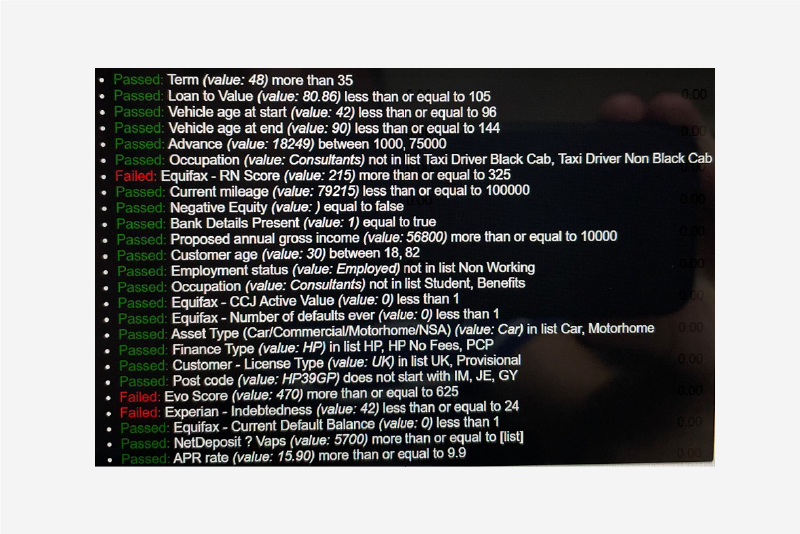

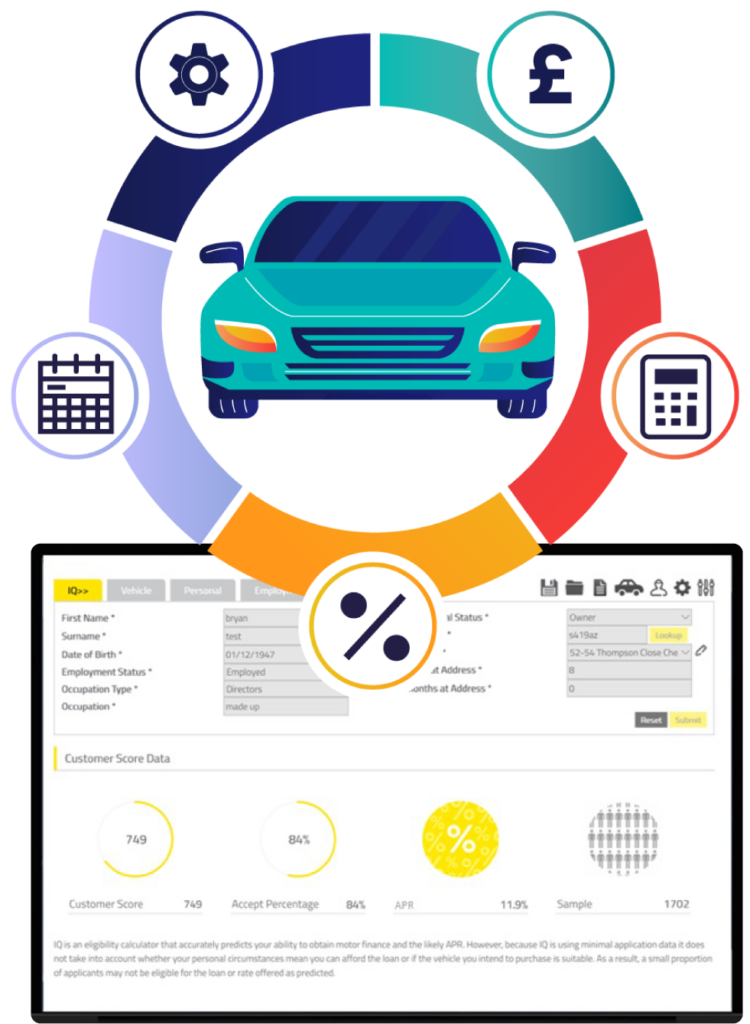

Every proposal received on our platform is soft searched on Equifax and Experian, where score data, full CAIS, alias, associate, and linked address data are obtained.

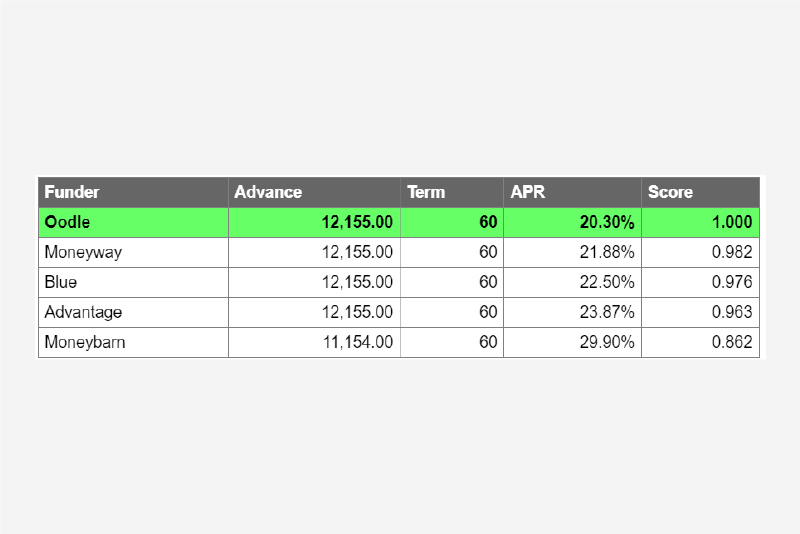

The combined data from the two main credit bureaus used by most lenders in motor finance is then passed through Evolution’s unique algorithm to produce an “Evo Score”. This score and the specific characteristics and demographics of the proposal are washed across Evolution’s transactional data from our historical book, containing millions of actual lender interactions to accurately predict the likely outcomes and lenders for any given proposal.

This powers a host of functionalities within our product and proposition, underpinning:

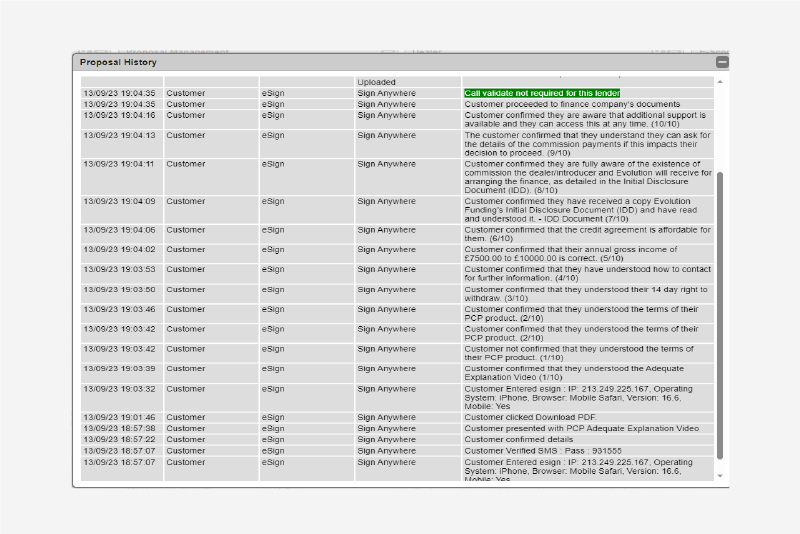

At each stage of the proposal journey, we ensure the best outcome for the customer is achieved, along with providing all the information and support required for the customer to make informed decisions.

All our processes, from lender selection to our e-Sign and ID&V verification, are documented and auditable during the transaction and post-transaction phases.

At any time, both now and in the future, we can demonstrate how a particular outcome was obtained and that it was also the best outcome available.

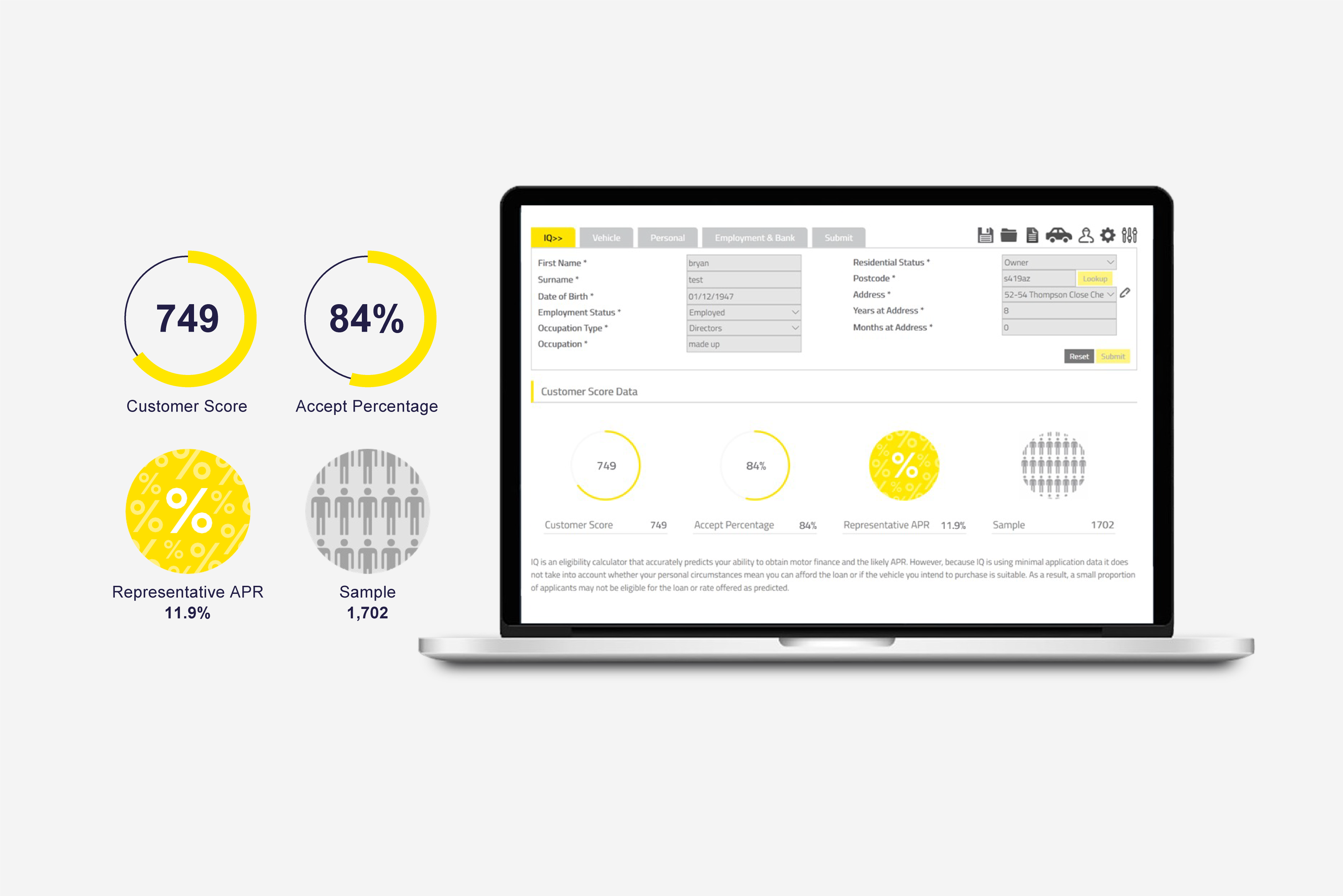

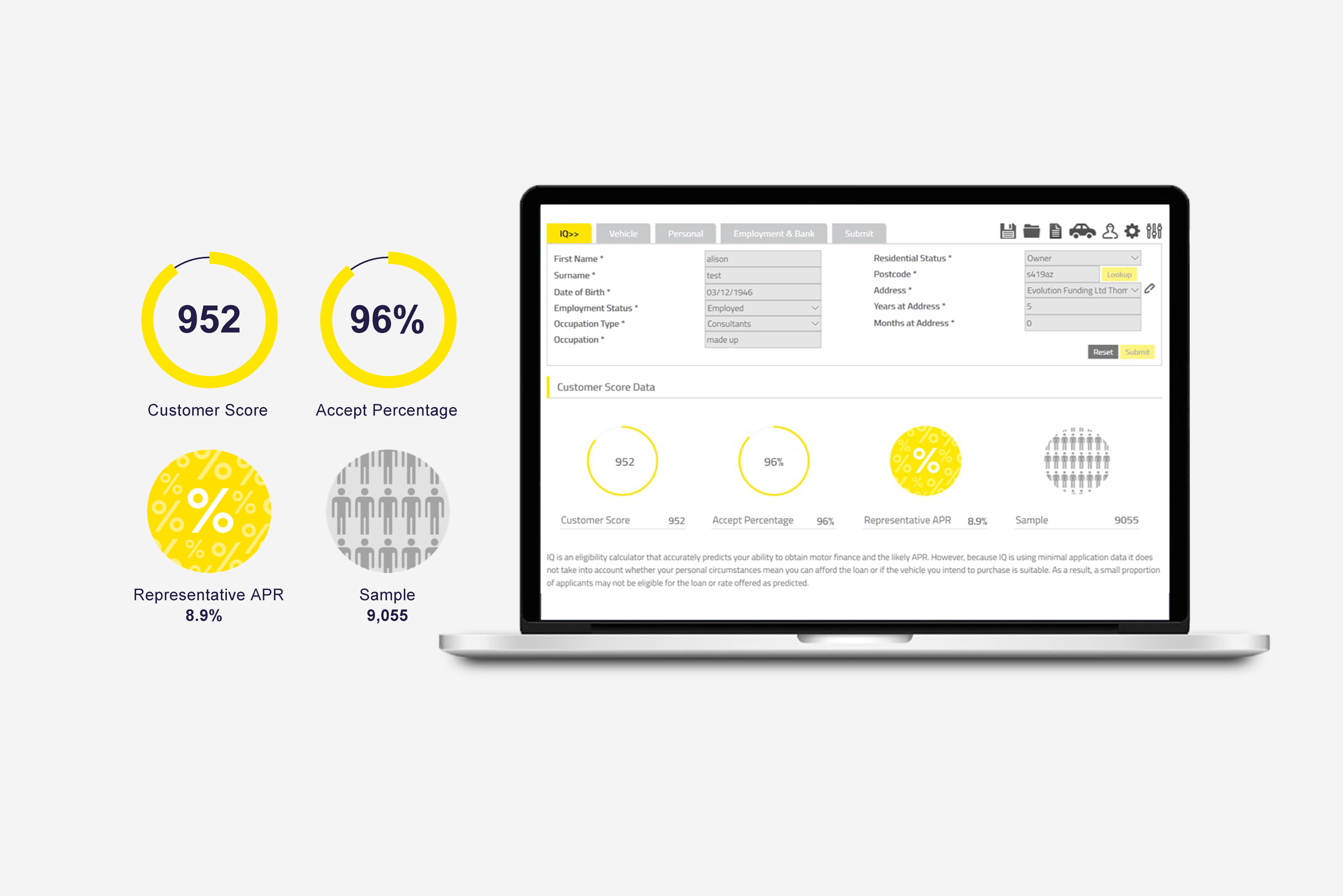

Dealers can access the Evo Score and eligibility predictions via our point-of-sale system or our API from a soft search with minimal customer data required. This allows for pre-screening customers in the showroom and segmenting customer journeys based on the results and likely outcomes.

Varying APR by score and banding customers into APRs appropriate for their credit risk enables you to offer a competitive and suitable rate only to those whose risk justifies it.