Sales Procedure Guide

2.1 // Products

2.1 // Products

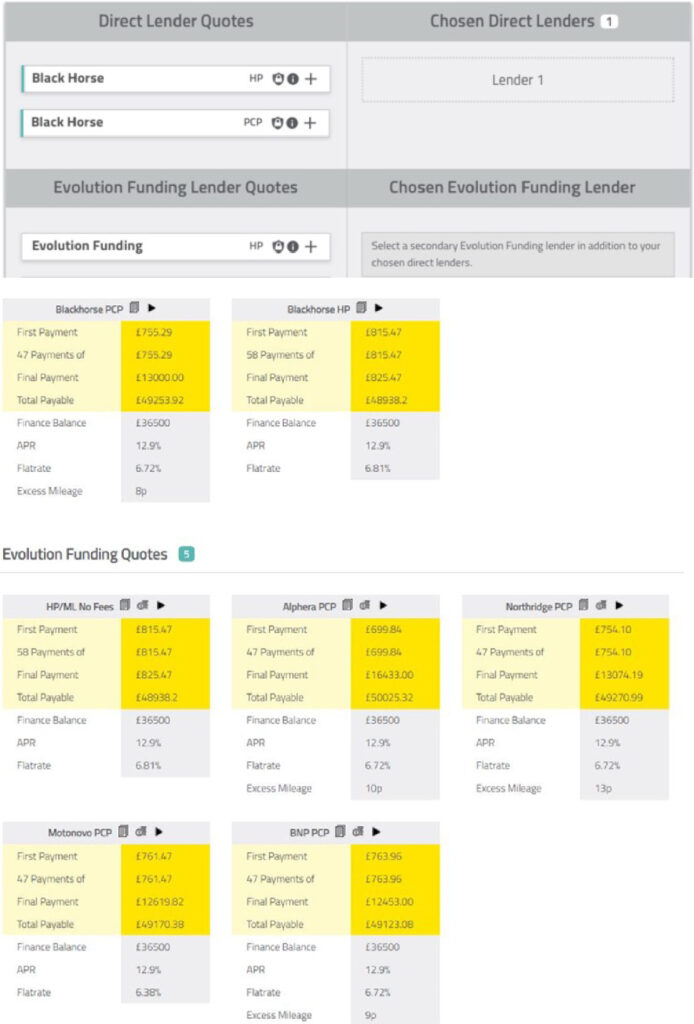

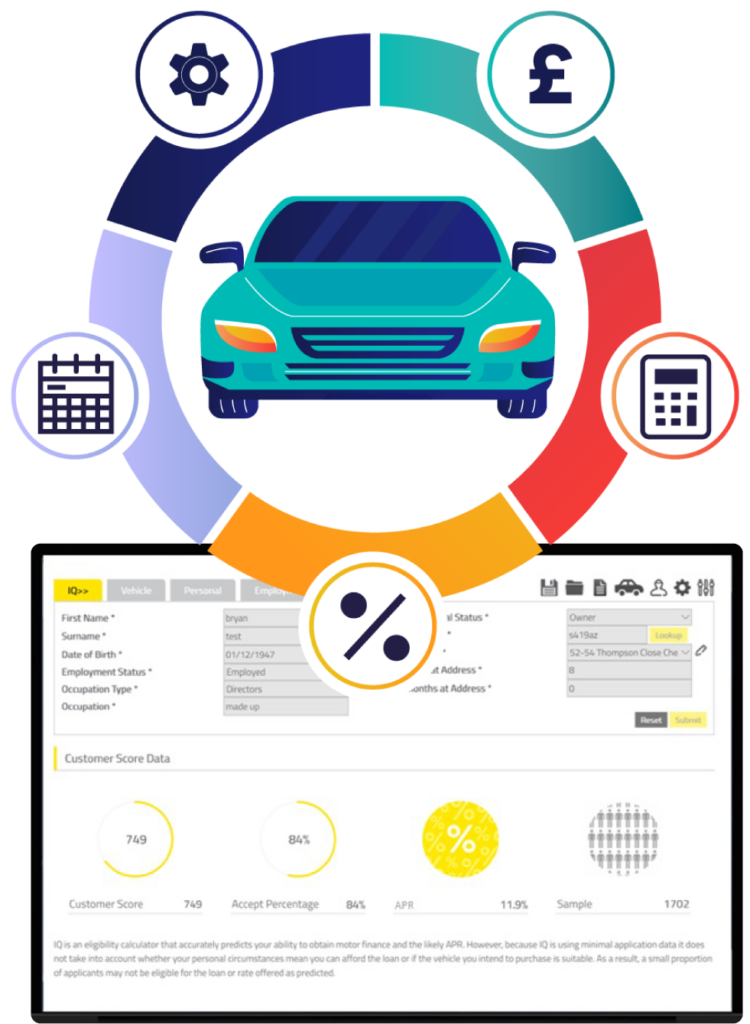

Evolution’s goal is to help you sell more vehicles on finance. How we support you is up to you. We have diverse products and technical solutions– from simple finance calculators to integrated, end-to-end digital finance journeys. With the ability to tailor product parameters to meet individual customer needs from a large panel of lenders, it should be rare that we cannot offer a suitable quotation for your customer and vehicle.

Whether it be the age of the vehicle, term required, GFV value, etc, we have an extensive panel of lenders plus the systems and controls in place to obtain the right outcome for each customer.

Gain further insight into our award-winning technology with this selection of product explainer videos and system walkthroughs and discover how we can support you in selling motor finance.

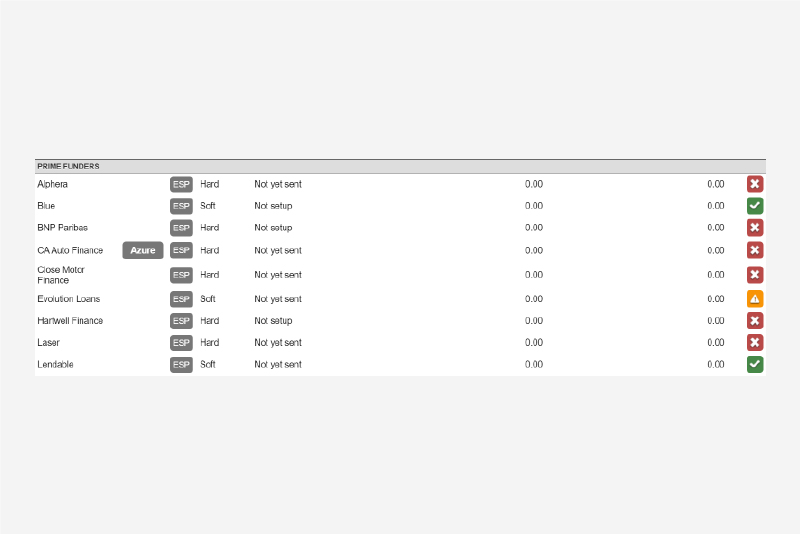

Partners can use Evolution’s platform to access multiple lenders while maintaining direct commercial relationships.

Use Evolution’s systems to propose directly to your first-string lender. Where your customer does not meet lender criteria, the application is automatically re-routed to Evolution’s panel, minimising admin and improving finance penetration.

Representing the world’s most prestigious car brands – including BMW, Ferrari, Audi, Mercedes-Benz, Land Rover and Porsche – Sytner Group operates from over 100 franchised outlets, plus eleven used car supermarkets.

Focusing on creating an exceptional customer experience, they aim to get it right the first time and make every interaction memorable. Evolution has been brokering out-of-core-terms business for Sytner’s franchised and used car operations for several years and writes more than £21M annual volume.

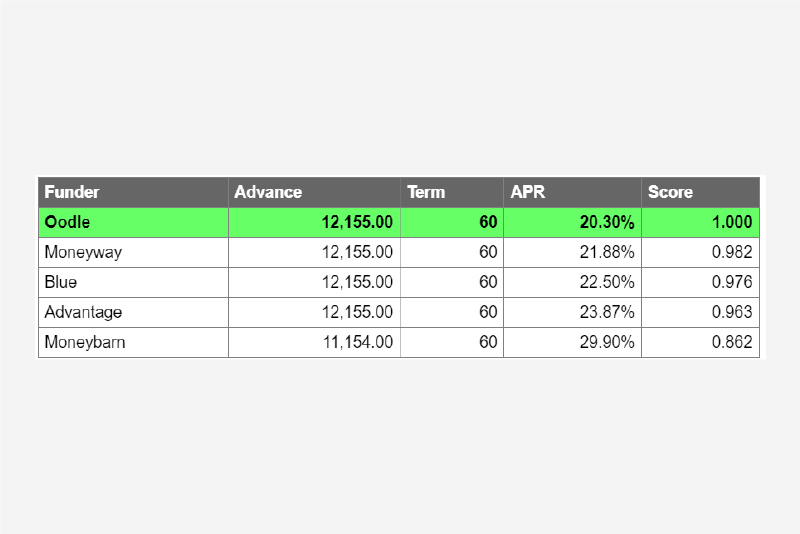

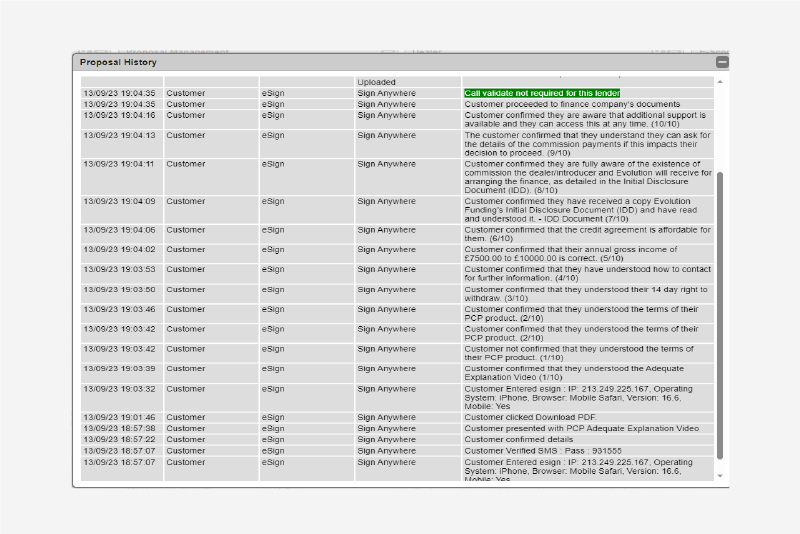

At each stage of the proposal journey we ensure best outcome for the customer is achieved along with providing all & any information, and support required for the customer to make informed decisions.

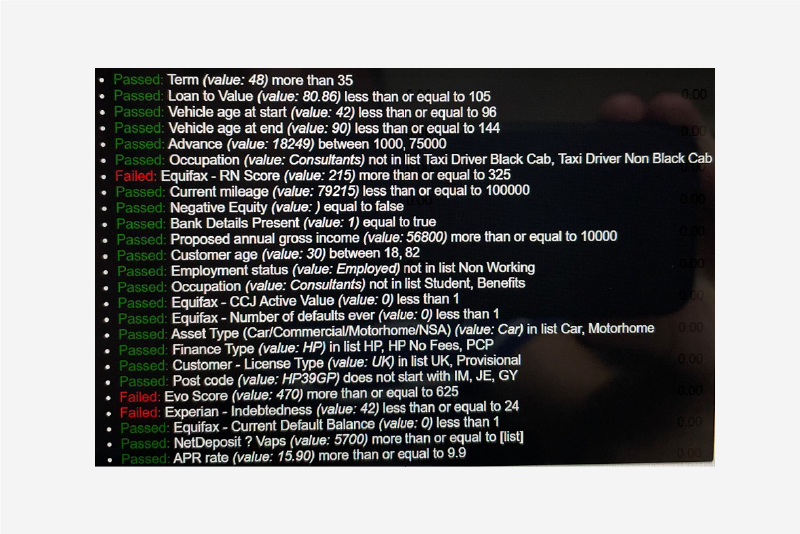

All our processes from lender selection through to our esign and ID & V verification are documented and auditable both during the transaction and in the future, post transaction.

At any time both now and in the future, it is possible for us to demonstrate how a particular outcome was obtained and that it was also the best outcome available.