Credit Pre-screening

Check customers for motor finance eligibility and deliver compliant, real rate pricing.

Credit Pre-screening

Today’s consumer expects their experience of shopping for motor finance to be like shopping for credit cards or holidays.

In short, they want a streamlined and digitised journey which gives them choice, instant quotes and no negative impact.

Our pre-screening technology delivers all of this whilst also reducing your admin and

processing time and costs.

Increased finance penetration

Eliminates admin of ineligible customers

Enhanced transparency & compliance

Delivers better customer outcomes

Increased finance penetration

Enhanced transparency & compliance

Eliminates admin of ineligible customers

Delivers better customer outcomes

Intelligent Quote (IQ)

In-showroom via DealerZone

Input your customers details – just name, address and date of

birth – to determine the likelihood and cost of credit without

impacting your customer’s credit file.

- Minimal customer data input required, soft search only.

- Credit score-based pricing delivers a compliant rate.

- Ensures you show the right cars to the right customers, based on affordability.

- Gives customers a realistic indication of their credit and buying options.

- Supports compliance by preventing credit impaired customers being searched unnecessarily by prime funders.

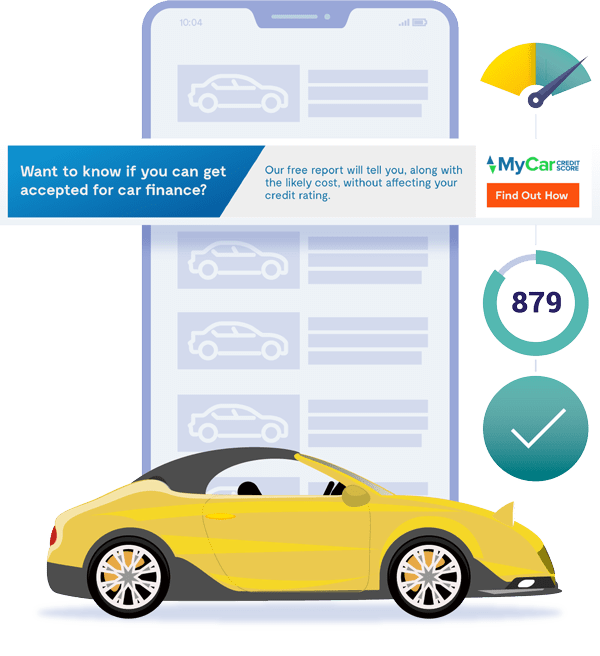

My Car Credit Score (MCCS)

Web-based eligibility checker

Display banners on your vehicle sales website inviting

customers to check their eligibility.

- Minimal data input, soft search only.

- Credit score-based pricing delivers a compliant rate.

- Delivers credit score, likelihood of acceptance and indication of cost of credit.

- Higher chance of a positive outcome due to large funder panel.

- Captures customer data, generating leads for your dealership.

- Can be white-labeled and branded to own UX/UI.

Comparison API

Rates comparison for Marketplace providers

Integrate your own platform with our Comparison API to display

highly compliant rate comparison tables, including pre-approved

rates for eligible customers.

- Minimal data input, soft search only.

- Uses whole of market for better customer outcomes.

- Rules-based algorithms deliver a compliant fixed rate.

- 100% eligibility pre-approves the customer for a real rate (rather than representative APR).

- Pre-approval leads to increased conversion rates.