Financial Promotions Guide

3.1 // Financial Promotions in Practice

3.1 // Financial Promotions in Practice

As part of your Consumer Duty, the FCA requires you to ensure you are targeting your audience correctly before creating your financial promotion for social media.

To make sure you are targeting your audience correctly, you should consider doing the following:

Communicate with those in your firm who regularly interact with your customers—they’ll know them best. Learn about your customers, their characteristics, and what drives them to help steer your messaging. Find out which social media platforms they use the most, and target accordingly.

Use data analytics to segment your audience based on age, location, and other relevant factors. Ensure that promotions are appropriate for the financial literacy and needs of each segment.

Use clear, jargon-free language to help your audience understand your financial promotion. Tools like Grammarly can help you simplify your messaging.

Before publishing your financial promotion, ask yourself how confident you are in knowing that your audience understands your promotion and what you are doing to measure that understanding. Here are some things to consider:

Once you have identified which social media platforms your audience uses the most, it’s crucial to understand the platform’s limitations and how each channel could impact your financial promotion.

Visual-Heavy Platform: Instagram prioritises visuals, with limited text space in the video or image.

Captions: While captions can be lengthy, the first few lines are truncated in the feed, meaning key information may be hidden unless users expand the caption.

Limited Click-Through Options: Instagram doesn’t allow you to place links in a caption. This limits the ability to direct users to additional information surrounding the financial promotion.

Limited Story Visibility: Instagram stories disappear after 24 hours, impacting the prolonged visibility of important disclosures in a financial promotion.

Character Limits: While Facebook posts allow for longer text, ads often require concise messaging, limiting the space for detailed financial information.

Ad Approvals: Facebook has strict ad policies, particularly for financial services. Ads can be disapproved if they don’t meet both Facebook and FCA guidelines.

X/Twitter

Character Limits: X’s 280-character limit restricts the amount of information that can be shared in a single post, making it difficult to include all the necessary information around a financial promotion.

Fast-Paced Feed: The rapid pace at which content is consumed on X can lead to important information being missed or quickly buried in other posts.

Threads: X threads are a series of connected posts. Any additional posts a part of the thread are hidden unless the user clicks on it. This means key information on the financial promotion could be missed, leading to non-compliance.

TikTok

Video-Only Format: TikTok’s format is exclusively video, which can make it difficult to include all necessary financial disclaimers and risk warnings within a short video.

Reduced Engagement: TikTok’s are purpose-made to be absorbed quickly. This may lead users to quickly gloss over important financial information in the promotion.

Limited Clickable Links: Like Instagram, you can not provide links in the caption of a TikTok video, limiting the ability to direct users to more information around the financial promotion.

Visual-Only Pins: Pinterest focuses on images and infographics with limited space for accompanying text. This can restrict the ability to include all the necessary information around the promotion.

Clickable Links: Pins can include a clickable link, but these links are not always obvious. Therefore, any additional information around a financial promotion could be missed.

With your audience, messaging, and social media platform in mind, it’s now time to create your financial promotion.

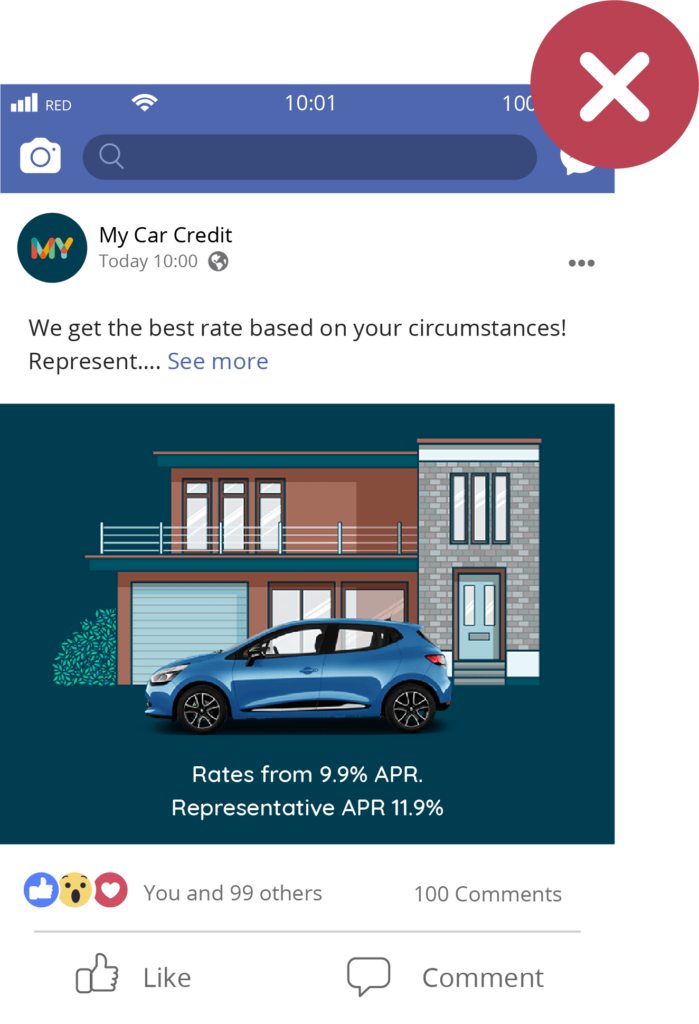

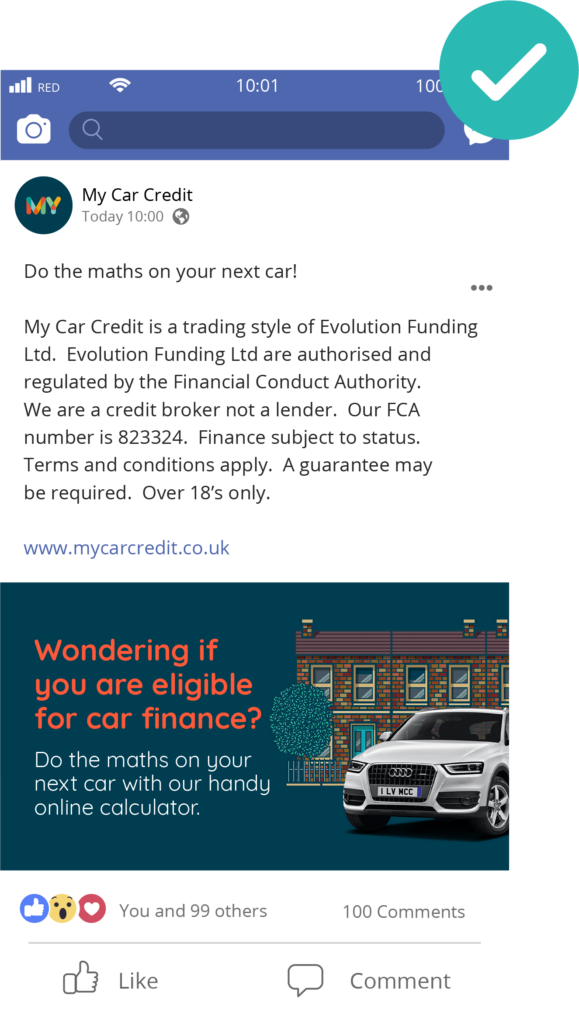

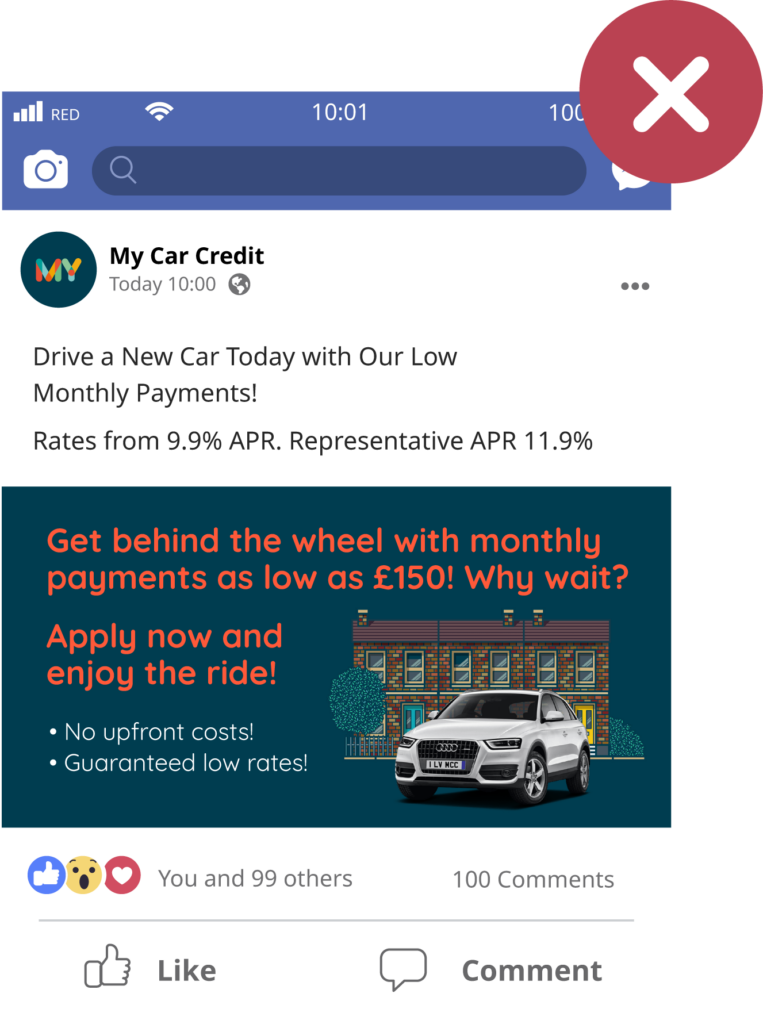

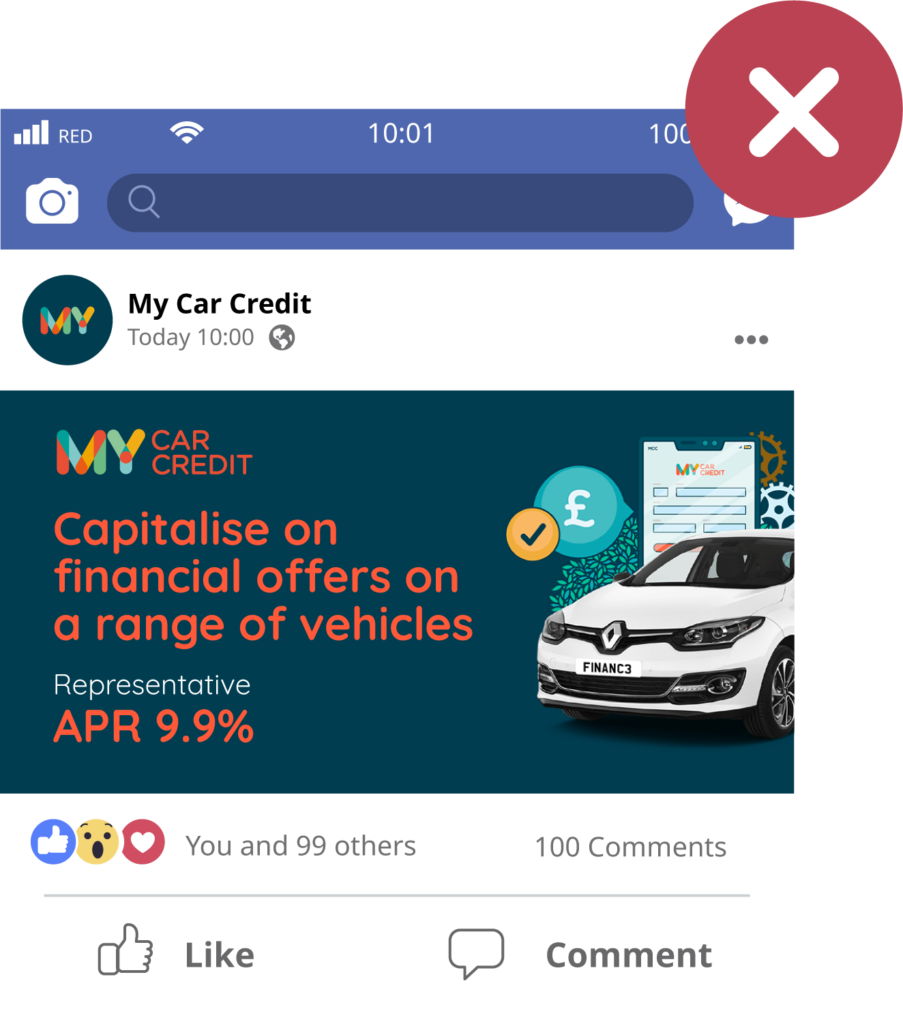

Here are some examples of best practices for social media financial promotions:

What is a Representative APR?

Read more >

When must a Representative APR be shown?

Read more >

If your financial promotion shows a rate of interest, e.g. 9.9% APR, or an amount relating to the cost of credit, you must provide a full representative example in your promotion.

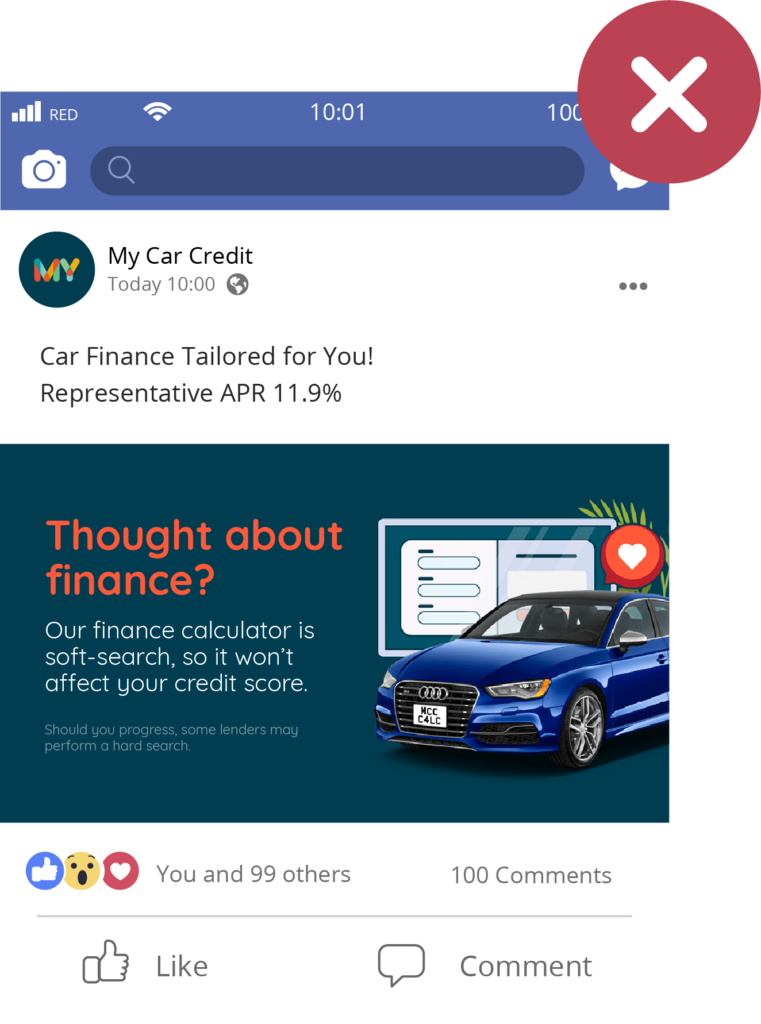

On platforms like Facebook, it’s important to be aware of hidden text and its impact on your financial promotion. Social channels only allow a certain number of characters to be shown until you have to click ‘see more’ to read the rest of the caption.

Therefore, you must ensure that key messaging can be read without clicking to read the rest. If this isn’t possible, review whether key messaging can be prominent in an accompanying graphic.

What makes a product or service ‘complex’?

To create an effective financial promotion, your customers need to be able to understand it. This means avoiding the use of jargon and long, complex phrases where appropriate. Keep it simple while still remaining compliant.

For your financial promotion to be compliant, it’s important that you do not highlight the benefits of the product or service more than the risks. They need to be represented equally so the customer can make a clear, informed decision.

The FCA have clarified that risk warnings should be equally as prominent as the benefits. However, the headline of the post can still appear larger than the risks and benefits on the promotion.