Financial Promotions Guide

3.0 // Social Media: Things to consider

3.0 // Social Media: Things to consider

The FCA states that their financial promotion rules are technology-neutral and apply across all channels used to advertise, including social media.

With the FCA placing more of a focus on financial promotions on social media, it’s helpful to consider a range of issues you may face, from creating the financial promotion to sharing it online. We cover these issues in more detail later on, but key things to consider are:

When trying to understand the FCA’s requirements and remain compliant, it can be easy to forget the following:

If you’re a public page on social media, an individual or another business page could likely share your posts – this means your financial promotion could land in front of different audiences. Depending on the platform and messaging of your promotion, this could disrupt consumer understanding, making your promotion non-compliant.

If you’re using an influencer to advertise your financial promotions on social media, you are responsible for ensuring they are not communicating illegal or non-compliant financial promotions.

Influencers should consider whether it is appropriate for them to promote the product or service, as well as ensuring they adhere to other rules and standards. The FCA and ASA have created an infographic with guidance for influencers to assess whether they are the right person to promote a product or service: Fin-fluencing? Get it right.

Influencers (or other unauthorised persons) who communicate a financial promotion without approval by an FCA-authorised person could be committing a criminal offence.

In May 2024, the FCA released a statement saying it had charged nine individuals with issuing unauthorised financial promotions.

Affiliate marketing is where a firm agrees to pay a commission to an individual or other firm to market their product or service.

You should have an appropriate monitoring process in place to ensure that affiliates understand their responsibilities and are communicating promotions in a compliant way.

If an affiliate is communicating a financial promotion which you were not involved in creating, which includes a referral link to your website, the FCA may still consider you as causing the communication to be made and, therefore, responsible for the compliance of the communication.

Firms and affiliate marketers should also ensure they are familiar with other standards and guidance that apply, such as the CAP Code: Online Affiliate Marketing – ASA | CAP.

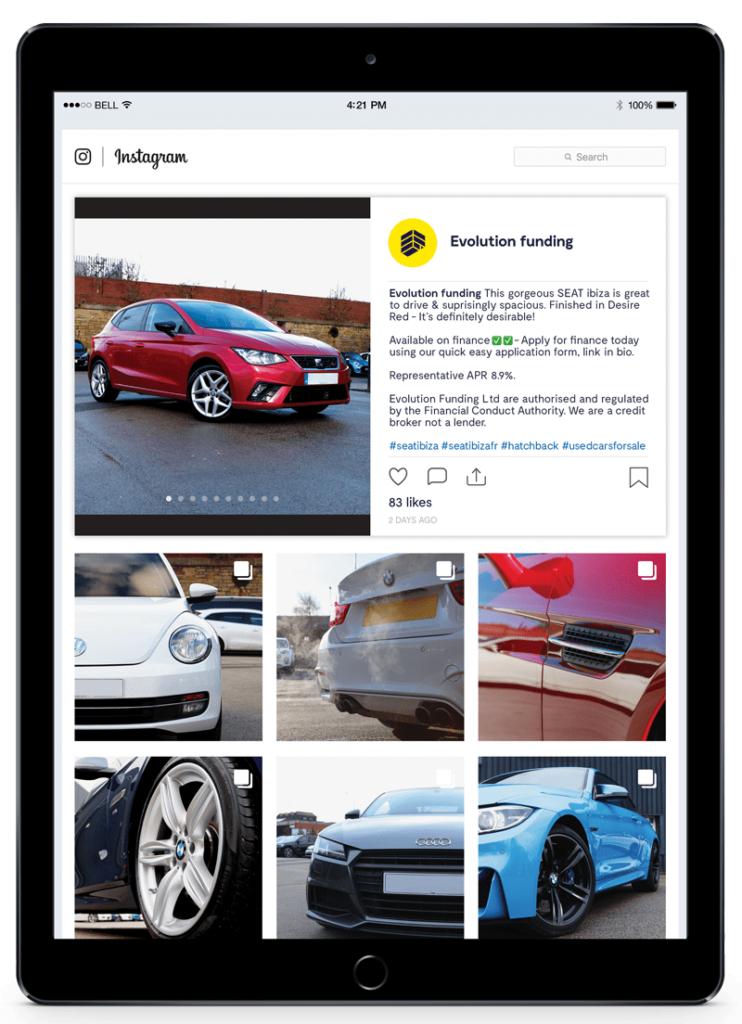

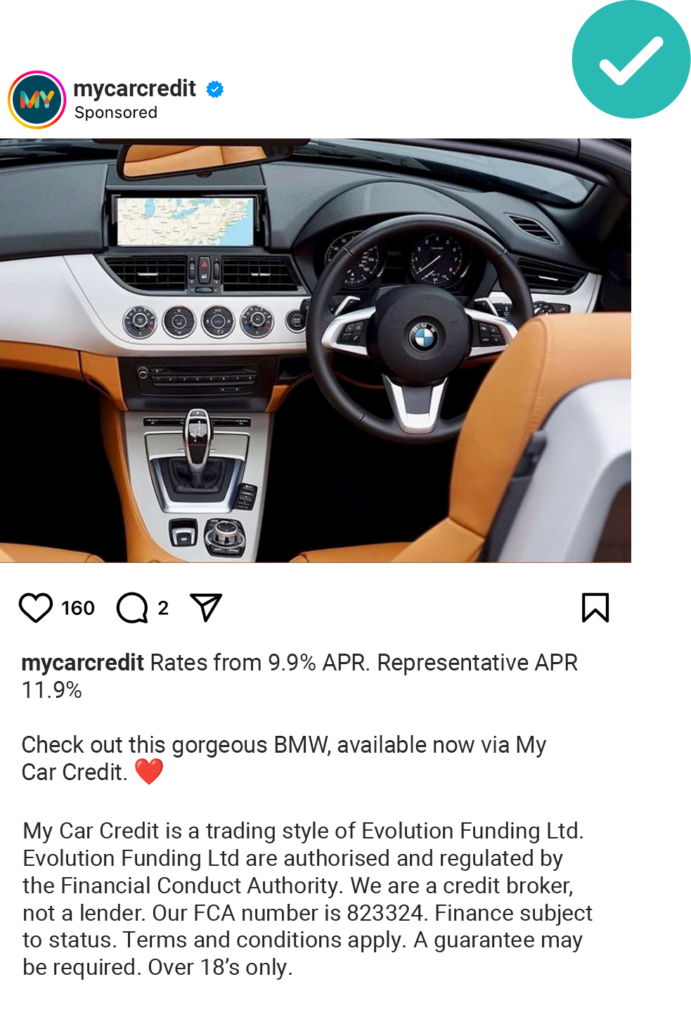

With platforms like Instagram and Facebook, you can post reels, allowing you to get your financial promotion across in more ways than one. Maintaining a proportionate view can be easily misjudged – you must detail the risks as much as the benefits.

A single reel

Consistent prominence

When choosing to use multiple reels, ensure each reel contains a summary of the key benefits and risks. This way, no matter which reels the consumer views, they receive the essential information upfront.

Interaction