Financial Promotions Guide

2.1 // Consumer Duty: Consumer Understanding

2.1 // Consumer Duty: Consumer Understanding

Consumer Understanding is one of four outcomes under the Consumer Duty that represent key elements of the firm-consumer relationship, and comprise of a suite of rules and guidance that set out more detailed expectations for firms under the duty.

The Consumer Understanding outcome is broader than specific disclosure requirements and applies to all financial promotions, other advertisements and communications provided to consumers, including verbally.

While firms must continue to comply with regulatory disclosure requirements, they must also consider the purpose of their communications and the outcomes they are focused on in order to meet the FCA’s expectations under Consumer Duty.

In their finalised guidance, the FCA provide examples of good practice in the way information can be presented to consumers:

Key information (such as the key features, benefits, risks and costs of the product or service) is provided upfront with cross-references or links to further detail.

Designing communications in a way that encourages engagement with them. Key information should be easy to identify, for example through headings and layout, bullet points, display and font attributes of text. Use of tables, graphs, diagrams, graphics, audio-visuals and interactive media can make the communication more engaging.

Where possible, jargon or technical terms should be avoided. If unavoidable, explain the meaning of key terms in plain and intelligible language that consumers are likely to understand.

The FCA expects firms to “bring the most important information to the attention of consumers in an accessible way”. Consider the appropriate level of detail, taking into account the information that customers need to know, the kind of decision to be made by the recipient of the communication, and where confusion could arise

Firms should communicate with customers in a timely manner and at appropriate touch points throughout the product life cycle, in order that they can make effective decisions on an informed basis.

A financial promotion must:

Some examples of business practices that are likely to fall foul of the clear, fair and not misleading rules include:

Word or expression | Restriction |

|---|---|

“Interest free” | Can only be used where there are no interest charges or fees of

any kind. |

“No deposit” | Can only be used if there is no advance payment of any kind. |

“Gift”, “present” or any similar expression | Can only be used where there are no conditions which would require

the customer to repay the credit, or return the financed item. |

“Weekly equivalent” or any similar

expression or other periodical equivalent | Can only be used if weekly payments or other periodical payments are

provided for under the agreement. |

The FCA may ask you to substantiate any claims you make in your advertising, so be prepared for this and make sure you could provide evidence if required, e.g. low rates, competitive rates, etc.

In a ‘Dear CEO’ letter issued to consumer credit firms in May 2022, the FCA highlighted the use of phrases such as “no credit check loans”, “loan guaranteed”, “pre-approved” or “no credit checks” in promotions by credit brokers. The FCA stated that while a credit broker may not conduct a creditworthiness assessment itself, they are concerned that this could mislead consumers into believing that the lender will not carry out any checks on their credit status.

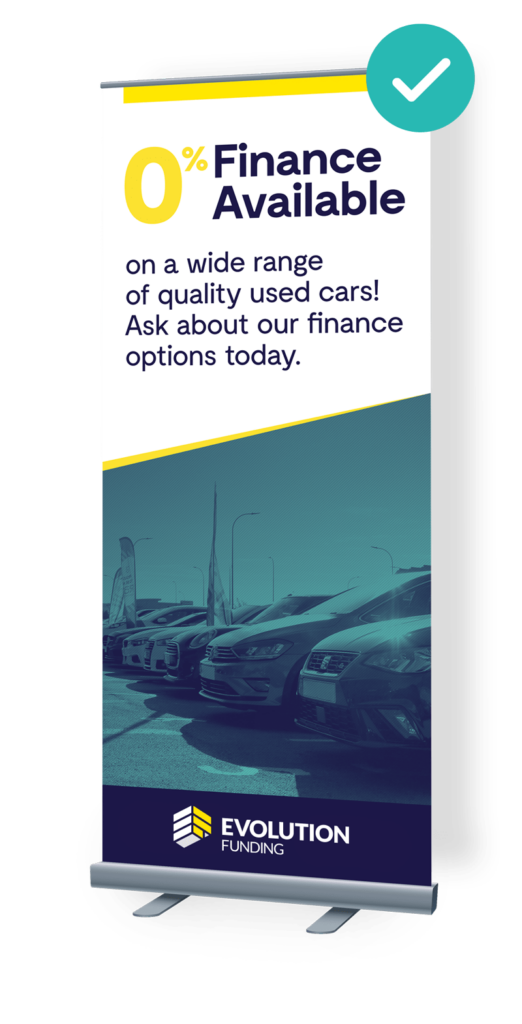

There are different rules where a financial promotion is completely free from interest or charges for the term of the agreement. You can promote 0% finance without triggering the need for either a representative APR or representative example.

Promotions of interest-free products are not exempt from any other regulations however, and must remain clear, fair and not misleading for consumers.

Read more about the clear, fair, and not misleading rules and general requirements in CONC 3.3 of the FCA handbook here.