Evolution Funding Group (“Evolution”), the UK’s largest automotive finance and digital commerce platform, has announced the acquisition of Automotive Compliance, a leading FCA-regulated provider of compliance services and systems to the UK motor retail sector. The transaction is subject to regulatory approval.

Founded in 2008 and based in Gloucester, Automotive Compliance provides regulatory oversight, governance, and compliance technology to over 1000 dealerships across the UK. The company supports dealers who are directly authorised by the FCA as well as those operating under an Appointed Representative structure, and is recognised for its strong brand, specialist expertise and comprehensive compliance systems.

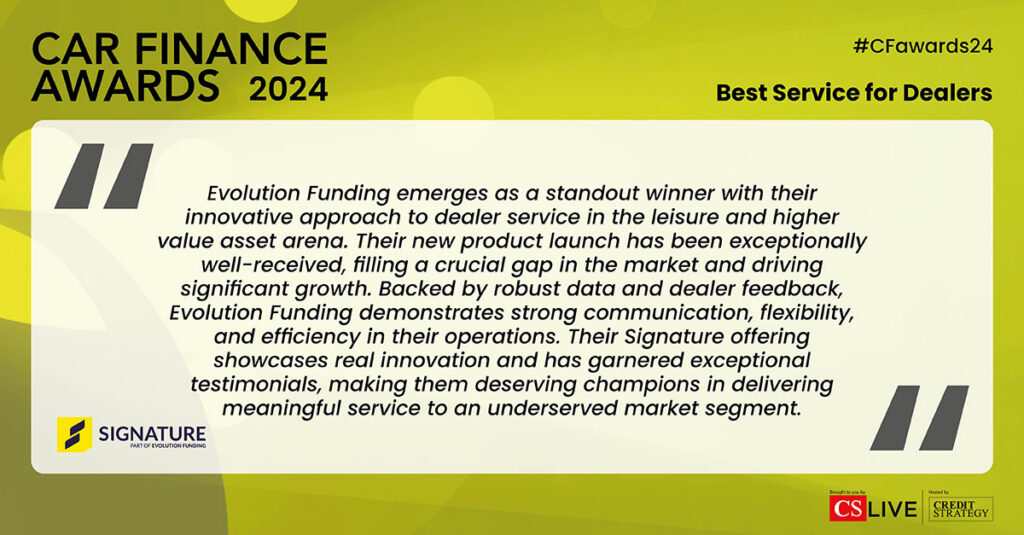

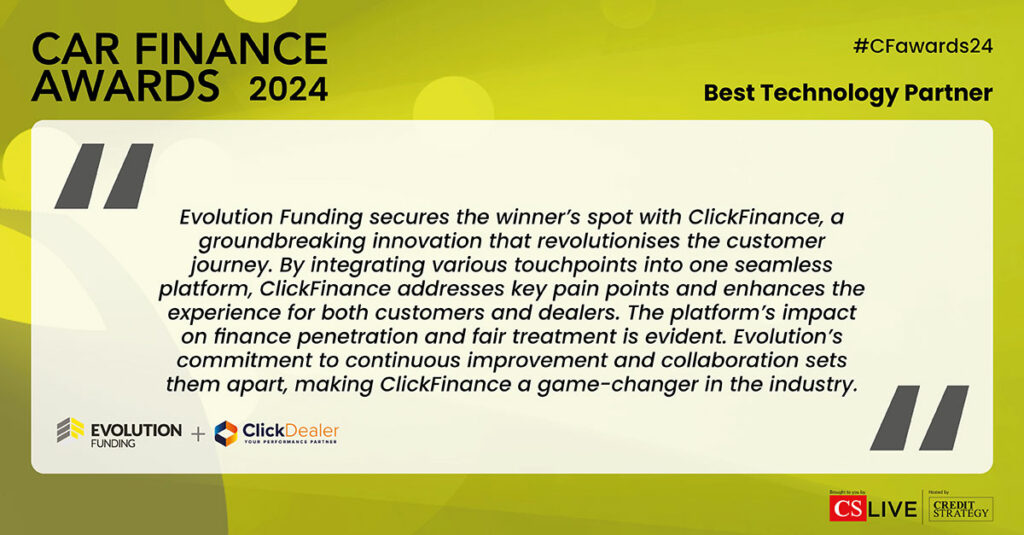

The acquisition forms a key part of Evolution’s strategy to build a fully connected, end-to-end platform for the automotive finance and retail market. Evolution already offers a broad suite of technology-enabled solutions, including brokered motor finance, direct-to-lender capability, digital retail tools, and dealer commerce systems through Click Dealer. The addition of Automotive Compliance completes the platform’s regulated capability, allowing Evolution to integrate compliance more deeply into dealer and consumer journeys.

Automotive Compliance will continue to operate as a standalone legal entity within the Group, with its leadership team remaining in place during the integration period, ensuring continuity for customers and partners. Evolution will invest further in the business to enhance its systems, expand service capability, and support growth across independent retailers, franchised groups, OEMs, and digital marketplaces.

Lee Streets, CEO at Evolution Funding Group, said:

“This acquisition is a hugely exciting moment for Evolution. Automotive Compliance brings the final piece of our platform vision to life, enabling us to offer a truly end-to-end solution for dealers, lenders and partners. They are one of the most respected compliance providers in the industry, and we’re pleased to be bringing their talented team and expertise into the group. Their knowledge, systems and experience strengthen us in all the right areas, and together we’re creating a more connected, compliant and innovative ecosystem for the automotive market.”

Paul Speakman, director at Automotive Compliance said:

“Joining the Evolution Funding Group is an exciting step for Automotive Compliance. We’ve spent many years building a trusted, respected compliance service for dealers, and this partnership allows us to take that to the next level. Evolution’s scale, technology and forward-thinking approach give our team and our dealers new opportunities to grow and innovate. We’re proud of what we’ve achieved so far, and we’re looking forward to what we can now achieve together.”

Paul Guy, director at Automotive Compliance added:

“Our goal has always been to make compliance clear, effective, and aligned to the realities of motor retail. Becoming part of Evolution allows us to strengthen that work with more scale, better tools, and wider capability behind us whilst playing a central role in the Group’s vision for integrated, compliant dealer and consumer journeys. It positions us strongly for the future and the growing regulatory focus across the market. We’re excited to be joining a group that shares our values and commitment to supporting dealers with the same practical, no-nonsense approach we’re known for.”

Evolution Funding Group is backed by investment from Carlyle and LDC.