Important Changes to Commission Disclosure Practices in Motor Finance:

How Evolution Funding is supporting dealers and what dealers need to consider

Information correct on 1 November 2024

Commission Disclosure Update

Overview

On the 25th of October 2024, the Court of Appeal handed down its judgment in the cases of Johnson v FirstRand Bank Limited, Wrench v FirstRand Bank Limited and Hopcraft v Close Brothers. You may have seen the significant press attention of the Judgment along with commentary from all corners of the market.

The Judgment is long and complex, and the motor industry has spent the last week understanding it and implementing changes to ensure compliance with the ruling.

This guide does not provide legal advice. What follows is a summary of the key takeaways, how Evolution Funding is responding to support your business, and key actions dealers may need to consider.

If you are in any doubt about your obligations, you should seek legal advice, and this guide is provided purely for information and guidance.

Understanding Your Duties as a Dealer when acting as a Broker: Key Points from the Judgment

The recent Court of Appeal judgment established important duties for dealers when arranging finance for customers. Here are some key points from the judgment:

Retailers who assist customers in obtaining finance, and are therefore deemed by the Court to be acting as credit intermediaries, owe a ‘disinterested duty’ to those customers.

A ‘disinterested duty’ is a duty to ‘provide information, advice and recommendation on an impartial and disinterested basis’.

Retailers were also deemed to owe a ‘fiduciary duty’, ‘due to the nature of the relationship, the tasks with which the brokers were entrusted, and the obligation of loyalty which is inherent in the disinterested duty’.

The distinction between a ‘disinterested’ and ‘fiduciary’ duty is complex but important when it comes to the test of whether the customer was provided enough information to give fully informed consent to the transaction. That discussion is beyond the scope of this update, but to ensure as best they can that retailers satisfy their duty to provide disinterested advice and fulfil their fiduciary duties, retailers must:

a. prominently disclose to customers, in good time before any finance agreement is entered into, the existence, nature and amount of commission a retailer will earn from a proposed deal.

b. also inform customers that they (the retailers) are acting as a credit broker but are not providing impartial or independent financial advice, that no recommendations will be given to the customer, and that as they (the retailer) are not acting in the customer’s best interests.

How is Evolution Funding Supporting Me?

In response to the Judgment, Evolution Funding has carried out a full review of how to ensure compliance with the new ruling for our dealers, lenders and customers.

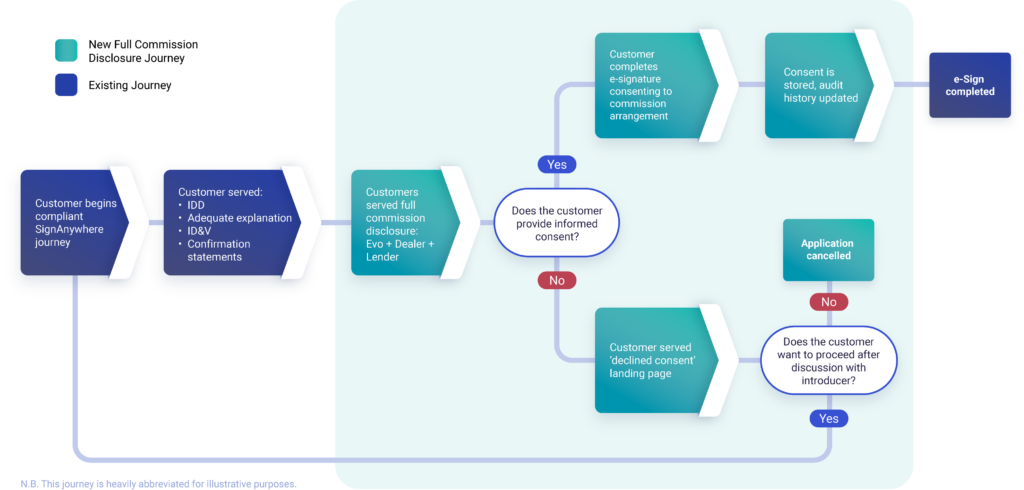

This has led to changes in our processes and systems to create an enhanced commission disclosure consent journey. Our updated journey addresses the heightened need for full transparency regarding informed consent, commission disclosures and additional duties.

Evolution Funding’s Updated Full Disclosure Process on Sign Anywhere

Sign Anywhere is our compliant digital signing portal. We have introduced a number of new steps into our disclosure journey. Our aim is to create an auditable, customer-centric process that captures fully informed consent. Our changes include:

- Updating our Initial Disclosure Document in-line with our duties to customers.

- Presenting the customer with a full commission disclosure including the commission payable to Evolution Funding from the lender, and the commission payable from Evolution Funding to the dealer.

- Creating an opt-out journey, where customers can choose to decline to consent to the commission arrangement.

- Providing the customer with further information if they choose to opt-out and keeping the dealer up to date.

- Allowing the customer to resume the Sign Anywhere journey after they’ve declined to consent to the commission arrangement, if they change their mind.

- Creating an E-signature, when the customer consents to the commission disclosure.

- Fully updating the audit history (which can be accessed through DealerZone).

- Updating our processes in Evolution Extra to manage non-prime customers through the commission disclosure process.

- Working with our lenders to streamline processes for our dealers and create new standards and best practices.

Steps You Can Take to Meet These Duties

To align with these enhanced duties and protect your business, here are some practical steps you may want to consider:

Review Your Initial Disclosure Document (IDD)

- Make sure your IDD clearly states your role as a credit broker, that you are not impartial, that you may act in your own commercial interests, and that you are not providing independent financial advice.

- Where possible, specify details around the commission and pricing arrangements, including any payments that you will receive from lenders or brokers. Clear commission disclosure is essential for meeting your duties and promoting customer understanding.

- When you deal with Evolution, we will also be discharging our regulatory duties and ensuring our compliance with law and regulation. Evolution will share our IDD with the customer to explain our role in the transaction. We will also obtain the customers fully informed consent to the commission payable from the lender to Evolution and from Evolution to you, in good time ahead of the customer signing the lenders documentation.

Share the IDD at Key Stages of the Sales Process

- Provide your IDD early in the customer journey, ideally before any finance discussions. This gives customers a chance to review commission information in advance of any decision being made.

- At this stage you may not know the exact commission amount that you will receive, but you should clearly inform the customer that you will earn a commission and explain how this will be calculated, to the fullest extent you can, including via your IDD as early as possible in the process.

- Consider sharing the IDD at several points in the sales process, such as in sales emails, and in initial discussions, to ensure customers are informed early and regularly

Document the IDD, Commission Disclosures and Customer Acknowledgments

- Keep records of when and how the IDD and any information around commission was provided to the customer. This helps you check your processes are working effectively and act as evidence of regulatory and legal compliance if you need them.

- Whenever possible, which may include at multiple points in the customer journey, obtain customer acknowledgment of the commission disclosure, either in writing or through recorded confirmations.

- We will obtain fully informed written consent from the customer for the commission payable to Evolution and you. This will be time and date stamped in Evolution’s systems, providing a full and auditable record of the customer giving fully informed consent.

The Next Steps

Evolution Funding is in constant conversation with its legal counsel, lender partners and introducers to form a best practice approach in an uncertain period which is changing rapidly.

As the dust settles on the Judgment, and the industry continues to collaborate to address the issues it raises, we will provide further updates as and when they are available.

Evolution recommends that you make these changes to your processes immediately. By making these changes to your disclosures and using Evolution’s Sign Anywhere journey, we believe that, as partners, our combined journey will comply with the new obligations imposed by the Judgment as the market understands it at this moment in time.

This document is for guidance purposes only. It is not formal advice as to whether any commentary and/or steps suggested, whether taken individually or cumulatively, are necessary or sufficient for dealers and/or brokers and/or lenders to comply with any obligations that may arise either from the Judgment, at common law or in equity generally, under statute or any other basis including compliance with the Financial Conduct Authority’s Consumer Credit Sourcebook. This guide may be subject to change and may only be deemed an accurate reflection of Evolution’s position at the time and date of publication.