“This year’s performance reflects consistent delivery against our strategy, made possible by the dedication of our teams and partners across the Group. Together, we continue to strengthen the platform and invest for sustainable, long-term growth.”

Lee Streets, CEO – Evolution Funding Group

The auto finance market is undergoing significant change. Rising consumer expectations, increasing regulatory complexity and rapid digitalisation are reshaping how vehicles are bought, funded and sold. In this environment, scale alone is no longer enough. Leadership is defined by clarity of direction, strength of platform and the ability to evolve with confidence.

Evolution Funding Group’s 2025 performance reflects a business growing with intent – deliberately investing in capability, strengthening its proposition and building a connected platform designed for long-term success.

Growth built on strategy, not volume

Evolution’s growth has been guided by a clear strategic objective: to create the UK’s largest used auto finance platform that supports sustainable, compliant and profitable growth for dealers, lenders and OEM partners.

Rather than pursuing volume for its own sake, the Group has focused on strengthening its foundations – expanding choice, improving efficiency and ensuring the platform can scale responsibly. This disciplined approach has enabled Evolution to expand its presence and influence across the market, while maintaining resilience in a changing economic and regulatory landscape.

Strengthening the Group through targeted acquisitions

Acquisitions play a critical role in how Evolution Funding Group continues to evolve. Each acquisition is driven by strategic fit and capability – bringing specialist expertise, technology or services that enhance the Group’s proposition and create greater value for partners.

The acquisition of Automotive Compliance is a clear example of this approach. By bringing compliance technology and specialist expertise directly into the Group, Evolution is simplifying complexity for partners and embedding trust at the heart of the platform. This integrated model is increasingly important as regulation intensifies and standards continue to rise across the industry.

A connected platform that delivers long-term value

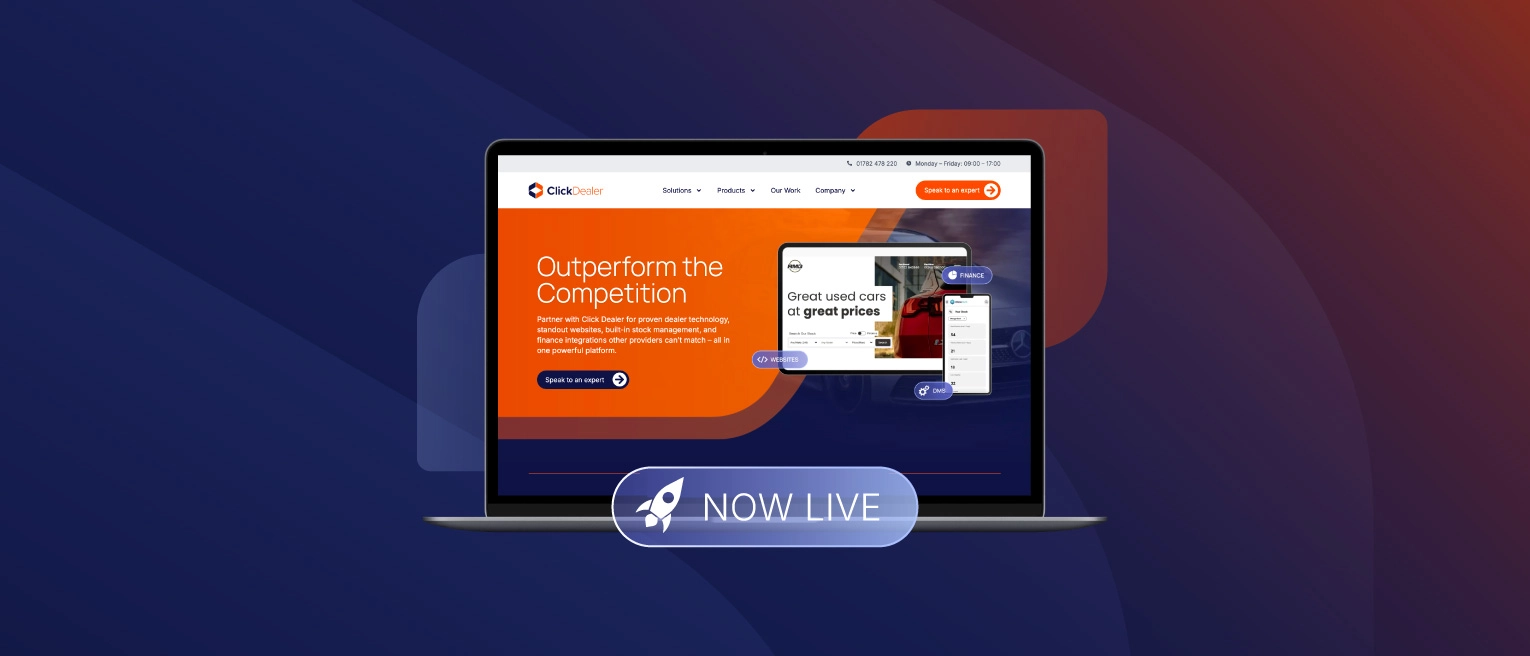

At the centre of Evolution Funding Group is a connected platform that brings together finance, technology, compliance and e-commerce. This integration reduces friction across the automotive retail journey, enabling faster decisions, greater transparency and more consistent customer outcomes.

For dealers and partners, this means less operational burden and greater confidence to grow. For lenders and OEMs, it provides scale, control and insight within a single, trusted ecosystem. For the Group, it creates a platform that can adapt and expand as the market continues to evolve.

Trust as a foundation for leadership

As Evolution grows, trust becomes even more critical. Protecting customers, partners and the integrity of the platform is fundamental to long-term leadership.

Trust at Evolution is built through technology-led safeguards, strong governance and a culture of service excellence. It is reinforced by long-standing relationships across the industry and by recognition for both performance and customer experience. This focus ensures that growth is sustainable, responsible and resilient.

Leading the industry through change

The transition to electric vehicles, the rise of OEM-led journeys and increasing automation are redefining auto finance.

Evolution Funding Group is actively enabling this change – investing ahead of demand to ensure partners are equipped for the next phase of the market.

By combining scale with innovation and strategic foresight, Evolution is not simply responding to industry change but helping to shape it.

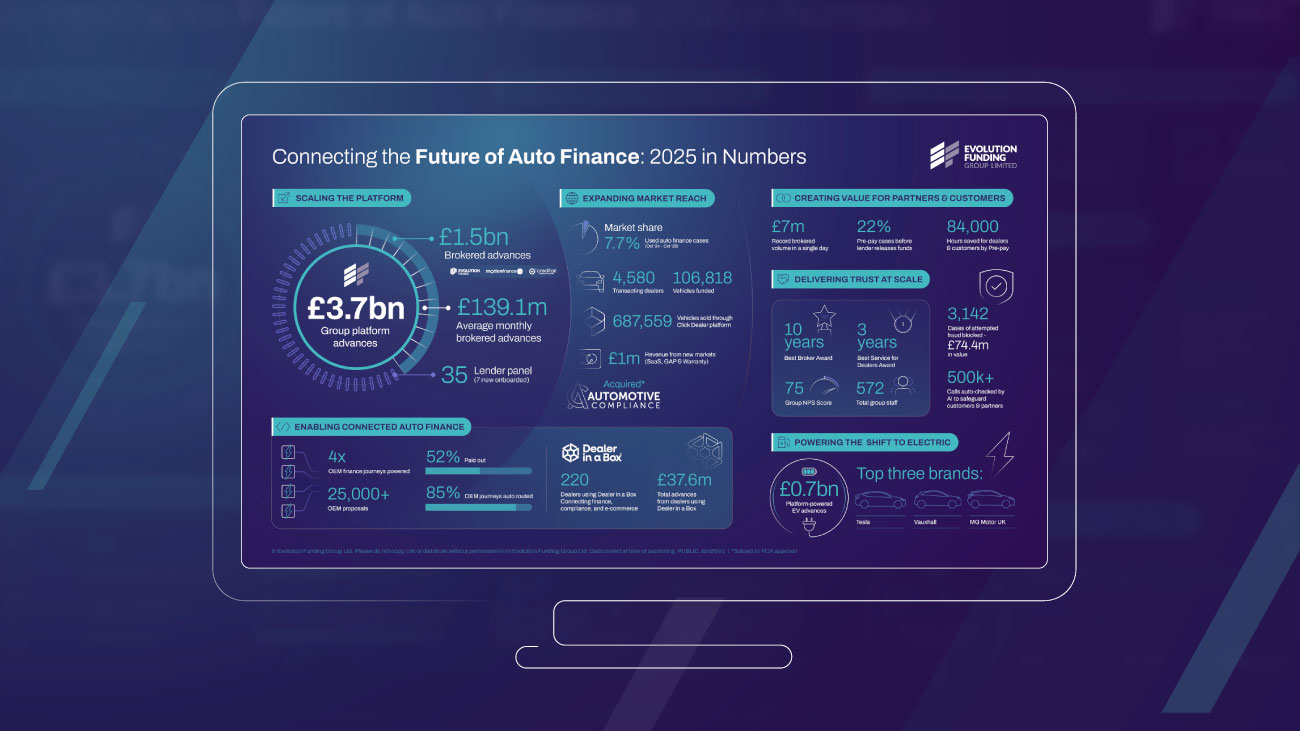

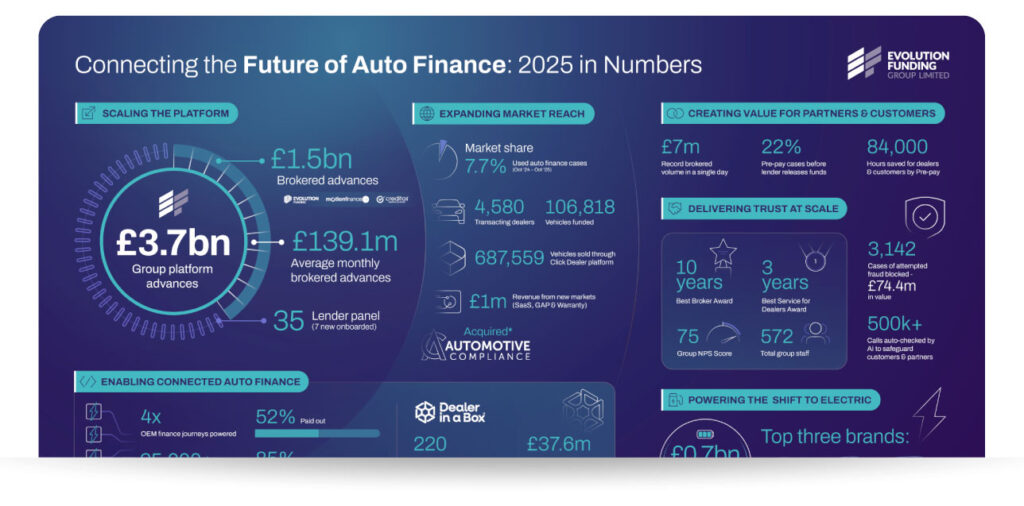

2025 in numbers

Evolution Funding Group Performance Snapshot

Looking ahead

Evolution Funding Group enters the next phase of its growth with a clear sense of purpose: to build a connected, trusted and future-ready auto finance platform that delivers lasting value for dealers, partners and investors alike.

The numbers reflect the scale of the business today. The strategy behind them defines where Evolution is going next.