Evolution Funding has been awarded ‘Best Broker’, ‘Best Service for Dealers’, Best Response to Market Conditions’, and ‘Best Use of Technology’ at the Credit Strategy Car Finance Awards 2025.

Best Broker

Evolution Funding’s Best Broker entry showcased its rapid regulatory response and market leadership following the Court of Appeal judgment—implementing 23 process changes in just 28 days and launching digital compliance updates in six.

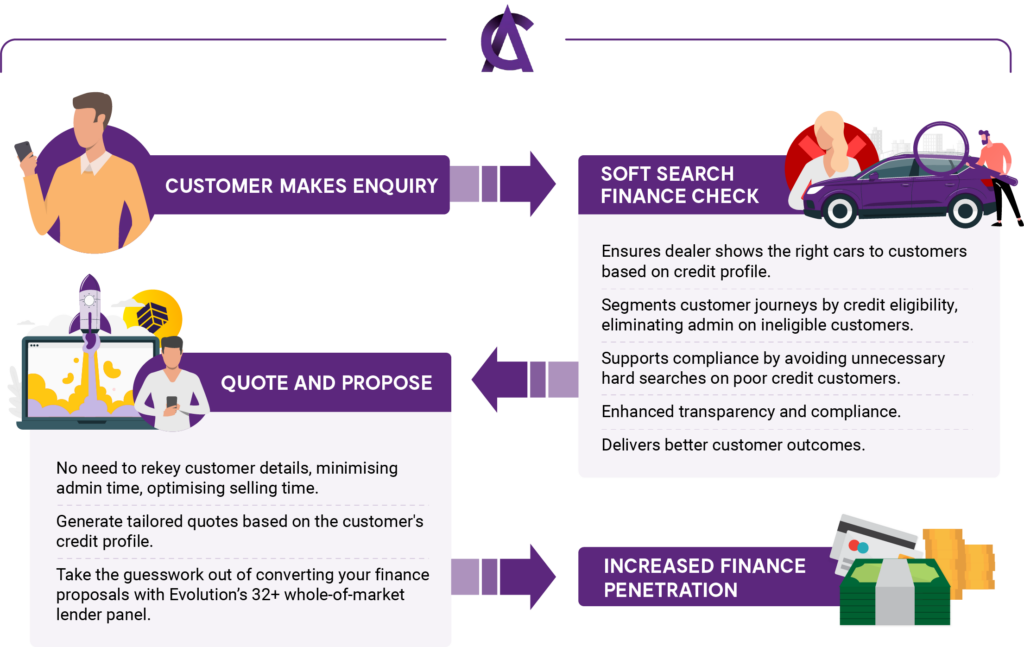

As the UK’s largest broker, Evolution became the industry’s central hub, even consulted by the FCA. Its automation-first approach delivered 6,000–10,000 dealer hours in monthly time savings, reduced customer touchpoints by 30%, and boosted conversions by up to 10%.

Backed by exceptional growth, operational innovation, and a scalable support model, Evolution proved it doesn’t just adapt to change—it defines the standard for the motor finance industry.

Judges' Comment:

Best Service for Dealers

Evolution Funding’s Best Service for Dealers entry highlights a transformative year of automation, structural change, and proactive support.

Our Pre-Pay technology and RPA-led processes saved dealers up to 10,000 hours monthly, enabling faster handovers and enhanced customer experience. A restructured Sales Centre of Excellence and 30-minute SLA Helpdesk delivered seamless service, boosting conversions and cutting delays. Regulatory agility following the Court of Appeal ruling ensured minimal disruption, with 23 process updates delivered in just 28 days.

From proposal to payout, Evolution’s streamlined, data-led approach continues to drive dealer success through measurable improvements, trusted relationships, and rapid market responsiveness.

Judges' Comment:

Best Response to Market Conditions

Evolution Funding delivered a decisive, industry-leading response to the Court of Appeal motor finance judgment. Within six days, we launched fully digitised compliance updates—followed by 23 process changes in just 28 days—ensuring business continuity while others stalled.

Engaging with 34 lenders, dealer groups, and the FCA, we shaped a scalable, transparent solution that balanced regulatory needs with customer understanding. With 99.9% customer consent, our approach didn’t just meet requirements—it set a new benchmark for trust, clarity, and industry-wide readiness.

By prioritising insight, adaptability, and consumer empowerment, Evolution led the market through unprecedented change with confidence and control.

Judges' Comment:

Evolution Funding’s partnership with Voyc has revolutionised call monitoring and compliance through AI. Replacing manual sampling with 100% automated QA on 55,500 monthly calls, Voyc instantly flags vulnerability, dissatisfaction, and compliance risks—freeing teams to focus on coaching and resolution. With 94% alert accuracy and a 20%+ drop in compliance errors, the system enables real-time support and tailored interventions, including for vulnerable or dyslexic customers.

The result: a 21% improvement in call quality scores and industry-leading First Call Resolution at 81%. This technology-driven approach sets a new benchmark in operational efficiency, customer care, and regulatory excellence.

Judges' Comment:

The Car Finance Awards 2025 took place on 21 May at the stunning Monastery in Manchester—a fantastic evening celebrating the very best our industry has to offer. We were proud to stand alongside so many worthy finalists and extend our heartfelt congratulations to all the winners. It was a night to recognise innovation, dedication, and excellence across the sector, and we’re honoured to have been part of it.