Supreme Court Motor Finance Ruling Update for Dealers & Partners

First Roundup

Supreme Court Motor Finance Ruling Update for Dealers – First Roundup

On Friday 1st August 2025, the Supreme Court handed down their long-awaited judgement on three motor finance cases upheld by the Court of Appeal.

We have worked over the weekend to give you this first roundup of what we know so far, with more to follow.

We hope this is a helpful summary of the court decision and the FCA consultation on a redress scheme that is now confirmed.

Please note that this is our own views on the events of the past few days and by no means does this replace any legal or regulatory advice you may look at obtain yourselves.

Recap on How We Got Here

The Court of Appeal heard three appeals and gave judgement on 25 October 2024 at 10.30am. Fiduciary duties were deemed to apply to dealers when arranging finance.

Obligations on a fiduciary include:

- Single minded loyalty, act in good faith, not make a secret profit.

Receiving a commission payment, the amount of which the customer was not aware of, deemed a secret profit. This meant customers had to agree to the amount of commission paid, something not previously required.

In the Johnson case, there was deemed to be an unfair relationship under s140A of the Consumer Credit Act 1974.

What Has the Supreme Court Decided?

The Supreme Court has ruled that the Court of Appeal was wrong to find that car dealers owe customers fiduciary duties when arranging finance.

Fiduciary duties can only arise where the dealer agreed to act in the customer’s interest instead of their own.

Dealers do not owe fiduciary duties when arranging finance.

A fiduciary duty is necessary to establish whether the payment of an undisclosed commission is a bribe. If no duties exist, the payment can never be a bribe.

The unfair relationship in the Johnson case was upheld. The relationship was deemed unfair due to:

- Size of commission - £1,650.95 (55% of the cost of credit, 25% of the advance);

- The dealer involved had a contractual obligation to send all business to First Rand first, but the dealer implied to the customer they had a panel;

- Disclosure that commission may be payable buried deep in documents customer unlikely to read; and

- The customer was financially unsophisticated.

It was, however, ruled that all unfair relationship claims are fact specific and a broad-brush approach is inappropriate.

So, What Does All This Mean?

All claims based on failure to disclose the amount of commission largely fall away. This avoids claims for repayment of all commissions ever paid where the amount was not disclosed. It is still possible to show a relationship may be unfair under the Consumer Credit Act.

The FCA is going to consult on a redress scheme, and we suspect this will be based upon:

Cases where DCAs (discretionary commission disclosures) are present and some non-DCAs with characteristics of Johnson’s case.

Determining the criteria for customers to be eligible to claim under the redress scheme.

Possible other factors such as being able to prove the customer actually suffered hardship as a result.

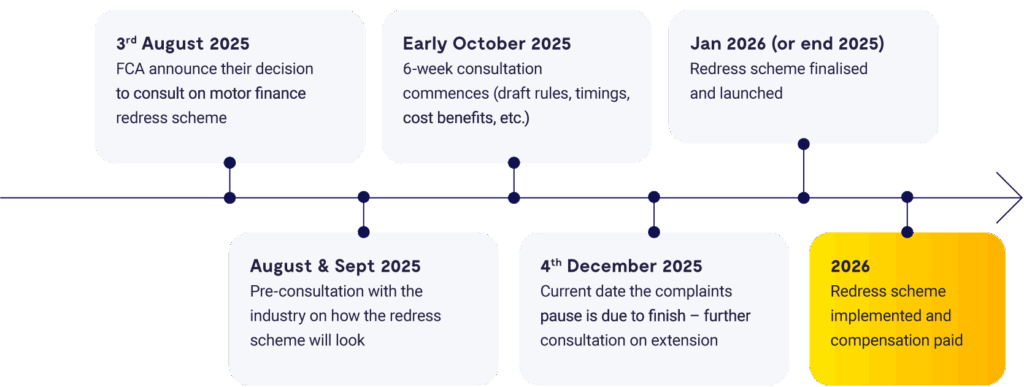

What Happens Next?

Considerations for Scope and Structure of the Redress Scheme

The FCA have stated that where consumers have lost out, they should be compensated. They are currently looking at agreements going back to 2007.

£9 billion has been quoted by the FCA as the likely minimum cost for the industry, including administration costs, etc.

DCAs are being considered up to 2021 ahead of when they were banned, but the FCA is also looking at some non-DCA commissions, following the Supreme Court decision on Johnson.

Consideration will be given to factors that could be unfair, such as the size and nature of commission, consumer characteristics, regulatory rules, and the extent and manner of disclosures that were made to consumers.

Post the Supreme Court judgement on Johnson, non-DCA arrangements and the tied relationships that dealers had to lenders will now be considered by the FCA.

The redress scheme may require customers to make a claim to their lender (opt-in) or leave it to their lender to determine whether they are eligible (opt-out) to make a claim under the scheme. The FCA sees pros and cons to each and will be considering both in their consultation.

The FCA need to define the methodology to be used for the redress. This will need to consider any harm to consumers but ensure the market can continue to offer affordable car finance to consumers.

55% commission was determined by the Supreme Court to be high, but this is not necessarily the floor that high commissions need to be above.

The redress scheme will not include every customer that took out finance where a commission was paid. Instead, only customers who meet the FCA’s eligibility criteria will be able to make a claim under the scheme.

The FCA estimate eligible consumers are likely to receive under £950 compensation per agreement and they are encouraging consumers to complain now, reminding them they don’t need to use a CMC.

These are all elements for consultation BUT nothing is set, and definitions are needed.

This document is for guidance purposes only. It is not formal advice as to whether any commentary and/or steps suggested, whether taken individually or cumulatively, are necessary or sufficient for dealers and/or brokers and/or lenders to comply with any obligations that may arise either from the Judgment, at common law or in equity generally, under statute or any other basis including compliance with the Financial Conduct Authority’s Consumer Credit Sourcebook. This guide may be subject to change and may only be deemed an accurate reflection of Evolution’s position at the time and date of publication.